morchu

08-02 01:14 AM

I believe it is worth the 180 days wait. And AC-21 is practical for a lot of situations. Anyway you dont really have to wait 180 days, if you can convince the current employer not to revoke the 140 (at least for the next 180 days).

My answer should have been different if you were not eligible to file 485.

Also give some serious thoughts about filing 485 before marriage. If you are unlucky enough, it can have serious side-effects.

EB3 with PD of July 2006. I-140 Approved. 485 +EAD+AP filed 2 weeks ago.

I was contemplating on job change before dates became current in June and decision to accept 485....

Now that 485 is filed and this DUST has settled, wondering whether all this is worth the wait. (even 180 days).

Currently in my 5th year of H1b, by waiting out the 6 months, I'll also get 3 yr h1b ext. (and hopefully ead by then).

So is waiting 180 days the best choice? or screw all this and change! (I dunno if this AC21 etc etc is practical...same job description etc)

(I am single and those complexities are not to be considered I guess yet.

Plan is to try and change jobs on H1b and use EAD only if there is a dire need like layoff to find another job quicker)

My answer should have been different if you were not eligible to file 485.

Also give some serious thoughts about filing 485 before marriage. If you are unlucky enough, it can have serious side-effects.

EB3 with PD of July 2006. I-140 Approved. 485 +EAD+AP filed 2 weeks ago.

I was contemplating on job change before dates became current in June and decision to accept 485....

Now that 485 is filed and this DUST has settled, wondering whether all this is worth the wait. (even 180 days).

Currently in my 5th year of H1b, by waiting out the 6 months, I'll also get 3 yr h1b ext. (and hopefully ead by then).

So is waiting 180 days the best choice? or screw all this and change! (I dunno if this AC21 etc etc is practical...same job description etc)

(I am single and those complexities are not to be considered I guess yet.

Plan is to try and change jobs on H1b and use EAD only if there is a dire need like layoff to find another job quicker)

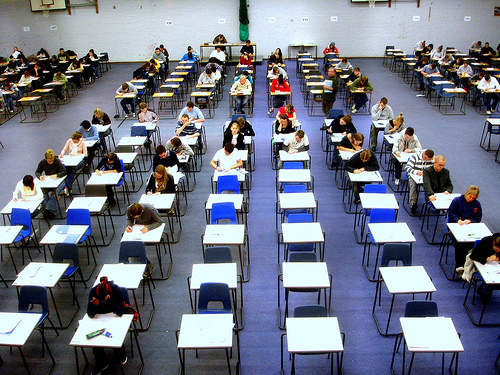

wallpaper exams. cool quotes on

hojo

10-27 11:47 AM

image maps

www.htmlgoodies.com

www.htmlgoodies.com

TeddyKoochu

01-06 10:04 AM

There will be no movement for EB2I without spill over. It seems this year is the key as the spillover expected is much more than the previous years (based on the pending application numbers). 10K from last year's family based leftover numbers should also go to EB2 I and EB2 C.

Any guidance when the FB numbers will be utilized or will they also be utilized in the last quarter. These are sufficient to clean out the EB2 I & C 2005 backlog.

Any guidance when the FB numbers will be utilized or will they also be utilized in the last quarter. These are sufficient to clean out the EB2 I & C 2005 backlog.

2011 funny quotes on exams. funny

.jpg)

humsuplou

03-09 12:54 PM

Yes, you can run a business on EAD.

You can own a business on H1-B too. But you cannot work for it . You can invest and have someone manage the operation for you. you can take profits but not work as an employee.

Ok, so one can own but not run a business with H1B, but can own and run with EAD,right?

Thanks!!

You can own a business on H1-B too. But you cannot work for it . You can invest and have someone manage the operation for you. you can take profits but not work as an employee.

Ok, so one can own but not run a business with H1B, but can own and run with EAD,right?

Thanks!!

more...

bank_king2003

09-13 03:27 PM

You can break height of injustice from USCIS by filling this. (WOM)

learn more about it online.

i have seen personaly a person filling this and IO calling him in the office approving it and apolgising for delaying.

you can hear other success stories online about WOM. sometimes court ordered USCIS to pay back all legal fees to the filer.

you need two things for this.

Balls + Money

regarding class action lawsuit, i am not sure if it could be filed or not against USCIS

learn more about it online.

i have seen personaly a person filling this and IO calling him in the office approving it and apolgising for delaying.

you can hear other success stories online about WOM. sometimes court ordered USCIS to pay back all legal fees to the filer.

you need two things for this.

Balls + Money

regarding class action lawsuit, i am not sure if it could be filed or not against USCIS

walking_dude

03-14 10:22 AM

There is nothing much IV can do to fix the inefficiency of the USCIS. How can IV help if USCIS cannot do its job in time? We can request them to work harder, thats all we can do.

Multi-year EAD/APs ( 3 years) are already part of the ongoing IV Admin fixes campaign. Having 3 year EAD/APs will fix some of the issues mentioned by you.

Guys,

I guess we are here long on waiting for our green cards in the mean time I am suggesting we do a letter campaign to write in thousands to the USCIS director and lodge our protest about the problem the immigrant community is facing because of delays and irregularities in adjudication of EADs and APs. First and foremost things is a document which USCIS takes 6 months to Adjudicate is valid for 1 year which makes no sense.

Secondly USCIS should make efforts to make adjudicate it in not more than 2 months since we have to make travel plans etc. We should not be bounded by these documents. If for some reason it takes more than 2 months than 1 should able to get it via infopass, and a family member's death should not be the only reason to get the AP we are human beings and we have other social bondings too like marriages etc. I urge the core team to take steps to come forward a begin a campaign.... I guess this is the foremost need of the moment for 1000s of us..

Multi-year EAD/APs ( 3 years) are already part of the ongoing IV Admin fixes campaign. Having 3 year EAD/APs will fix some of the issues mentioned by you.

Guys,

I guess we are here long on waiting for our green cards in the mean time I am suggesting we do a letter campaign to write in thousands to the USCIS director and lodge our protest about the problem the immigrant community is facing because of delays and irregularities in adjudication of EADs and APs. First and foremost things is a document which USCIS takes 6 months to Adjudicate is valid for 1 year which makes no sense.

Secondly USCIS should make efforts to make adjudicate it in not more than 2 months since we have to make travel plans etc. We should not be bounded by these documents. If for some reason it takes more than 2 months than 1 should able to get it via infopass, and a family member's death should not be the only reason to get the AP we are human beings and we have other social bondings too like marriages etc. I urge the core team to take steps to come forward a begin a campaign.... I guess this is the foremost need of the moment for 1000s of us..

more...

Springflower

04-15 03:56 PM

Enjoy the flexibility and the freedom GC provides.

2010 quotes on exams. cool quotes

abhishek101

05-17 05:50 PM

I have Master's degree from US and have been with the company for 6yrs. This is the response from my Attorney on porting to EB2 category. My I485 was filed during July 2007. What can i do to be able to file a new PERM LC for porting to EB2 category without affecting my I485 application? Please advise.

Thank you for your email inquiring about filing a new PERM labor certification (PERM LC) application to qualify for the EB-2 preference category. A final determination has been made on whether a new PERM LC can be filed.

Regulations that govern the PERM Labor Certification process do not permit an employer to file a new PERM LC application for the sole purpose of shortening the wait time in immigrant visa preference categories. Company will not file a new PERM LC unless it is clearly required by regulation.

We completed our research and legal analysis. The purpose of the research was to determine whether you can still benefit from your current case, or whether substantial job changes require, by law, a new PERM LC application to be filed on your behalf.

Our final assessment is that while some job changes have occurred, the changes are not substantial in the context of labor certification regulations. Please note that while the group, products and/or daily tasks in your employment may be different, these changes are not substantial from an immigration perspective and do not require a new PERM LC. In addition, portability provisions of the law allow considerable flexibility for job changes when an I-485 Adjustment of Status application has been filed.

This is not an internal policy matter, rather company's compliance with U.S. Department of Labor regulations that govern the PERM LC process.

What your lawyer is saying that your duties are not 50% different from the original filing. Seems you work for a big corporation.

I work for a fortune 10 company and one of my colleague got the exact same response when she tried the same thing. I moved from Tech to Finance and they were fine doing it for me. So try to change your job substantially and retry.

Thank you for your email inquiring about filing a new PERM labor certification (PERM LC) application to qualify for the EB-2 preference category. A final determination has been made on whether a new PERM LC can be filed.

Regulations that govern the PERM Labor Certification process do not permit an employer to file a new PERM LC application for the sole purpose of shortening the wait time in immigrant visa preference categories. Company will not file a new PERM LC unless it is clearly required by regulation.

We completed our research and legal analysis. The purpose of the research was to determine whether you can still benefit from your current case, or whether substantial job changes require, by law, a new PERM LC application to be filed on your behalf.

Our final assessment is that while some job changes have occurred, the changes are not substantial in the context of labor certification regulations. Please note that while the group, products and/or daily tasks in your employment may be different, these changes are not substantial from an immigration perspective and do not require a new PERM LC. In addition, portability provisions of the law allow considerable flexibility for job changes when an I-485 Adjustment of Status application has been filed.

This is not an internal policy matter, rather company's compliance with U.S. Department of Labor regulations that govern the PERM LC process.

What your lawyer is saying that your duties are not 50% different from the original filing. Seems you work for a big corporation.

I work for a fortune 10 company and one of my colleague got the exact same response when she tried the same thing. I moved from Tech to Finance and they were fine doing it for me. So try to change your job substantially and retry.

more...

desigirl

04-28 10:00 AM

Business groups, which have clashed with Democrats over everything from health care to Wall Street reform, have been working quietly with Congressional leaders and another one of their typical opponents � unions � to seek an immigration overhaul, says Benneth Roth

hair funny quotes on exams. funny

corleone

11-06 10:17 AM

can you let us know why u'r 140 denied? may be it can be useful for some of us how to open motion for appeal..

thanks,

srikanth

http://www..com/discuss/485eb/50526069/

thanks,

srikanth

http://www..com/discuss/485eb/50526069/

more...

prasadn

02-05 11:54 AM

Gurus,

I have a similar question. I filed for my 485 in June 2007. But, did not file for EAD at that time. However, I filed for my EAD in March 2008 with the new filing fee i.e $340. My EAD is up for renewal (it's valid till Jun 12th...but considering the 3 month wait time, I am plannig to file it around 13th of this month ).

Since I have already filed with the new fee structure I am hoping I dont have to pay any fees , right? But, I dont see any instructions to that extent. Can any one please point me to the right link or document?

Regards

As per my understanding, since you filed for 485 before August 17, 2007 you have to pay renewal fees for EAD/AP. ONLY if you have filed for 485 after August 17 2007 you don't have to pay renewal fees for EAD/AP.

What matters here is when you filed your 485. It does not matter when you applied for EAD/AP as these are based on your 485.

I have a similar question. I filed for my 485 in June 2007. But, did not file for EAD at that time. However, I filed for my EAD in March 2008 with the new filing fee i.e $340. My EAD is up for renewal (it's valid till Jun 12th...but considering the 3 month wait time, I am plannig to file it around 13th of this month ).

Since I have already filed with the new fee structure I am hoping I dont have to pay any fees , right? But, I dont see any instructions to that extent. Can any one please point me to the right link or document?

Regards

As per my understanding, since you filed for 485 before August 17, 2007 you have to pay renewal fees for EAD/AP. ONLY if you have filed for 485 after August 17 2007 you don't have to pay renewal fees for EAD/AP.

What matters here is when you filed your 485. It does not matter when you applied for EAD/AP as these are based on your 485.

hot cool quotes on exams. funny

Sunx_2004

07-09 11:01 PM

For private courier (non usps deliveries) there is different address please see in the Instruction on completing I-765 form on USCIS website.

I send my application via fedex today to following address..

For private courier (non-USPS) deliveries:

USCIS

Nebraska Service Center

850 S. Street

Lincoln, NE 68508-1225

I am not sure of USCIS P.O. Box address, but in general Fedex can't be sent to USPS P.O. Box.

Very rarely USCIS gives street address for sending application.

I send my application via fedex today to following address..

For private courier (non-USPS) deliveries:

USCIS

Nebraska Service Center

850 S. Street

Lincoln, NE 68508-1225

I am not sure of USCIS P.O. Box address, but in general Fedex can't be sent to USPS P.O. Box.

Very rarely USCIS gives street address for sending application.

more...

house funny quotes for exams. funny

Humhongekamyab

08-13 10:59 AM

This thread should be deleted. Not related to our cause.

tattoo cool quotes on exams.

minimalist

05-21 10:55 AM

For EAD ,the documentation is pretty simple and straightforward.

Please goto USCIS site and take a look at I765 form and the associated instructions. Once you spend 15 minutes on that, you will have most questions answered yourself. For the ones you have doubts, please post back.

Thanks

Please goto USCIS site and take a look at I765 form and the associated instructions. Once you spend 15 minutes on that, you will have most questions answered yourself. For the ones you have doubts, please post back.

Thanks

more...

pictures cool quotes on exams. cool quotes on exams. cool quotes on exams.

royus77

07-01 03:11 PM

Anyone willing to join the lawsuit should be willing to join by giving full information about themselves and about their application. Yesterday core members asked this question on a thread and only one person out of thousands of people who visited the site said they are interested. Let us see who all are truely willing to join this lawsuit? It is very easy to annonymously post such messages, but when people cannot even give their corect email id , name and phone number in their profile I highly doubt a lawsuit will be possible.

Let us see on this thread how many members are willing to join a lawsuit?

Mostly of the people just think its just giving the annonymous name,phone numbers and getting the benefit of the decision .Please read these point and understand carefully before jumping.

Please be aware, though, that USCIS is likely to examine plaintiffs’ adjustment of status applications more closely than it otherwise might. It may ask the plaintiffs questions and ask for additional information about their adjustment applications or immigration status. See below regarding “discovery.”

http://www.murthy.com/current485/VisaBulletinFAQ6-29-07.pdf

Let us see on this thread how many members are willing to join a lawsuit?

Mostly of the people just think its just giving the annonymous name,phone numbers and getting the benefit of the decision .Please read these point and understand carefully before jumping.

Please be aware, though, that USCIS is likely to examine plaintiffs’ adjustment of status applications more closely than it otherwise might. It may ask the plaintiffs questions and ask for additional information about their adjustment applications or immigration status. See below regarding “discovery.”

http://www.murthy.com/current485/VisaBulletinFAQ6-29-07.pdf

dresses funny quotes on exams. funny

cchaitu

07-24 04:27 PM

Hi,

If I have a permanent offer after 180 days of Receipt date (I 485)...

Is this offer should be in the same location (state) where my labor got filed ???

Please advice...

Thanks

If I have a permanent offer after 180 days of Receipt date (I 485)...

Is this offer should be in the same location (state) where my labor got filed ???

Please advice...

Thanks

more...

makeup funny quotes for exams.

mayhemt

06-02 06:42 PM

Shouldnt the title include petitions filed by one particular law firm:

'Fragomen, Del Rey, Bernsen & Loewy LLP' ??

(its a little misleading & intimidating to know 'ALL' applications)

'Fragomen, Del Rey, Bernsen & Loewy LLP' ??

(its a little misleading & intimidating to know 'ALL' applications)

girlfriend cool quotes on exams. funny

desi3933

03-15 02:57 PM

Thanks.

So employer has to inform USCIS about EAD use. But in this case (and termination) the actual H1b cancellation is USCIS decision ?

(The pdf does not state what action USCIS will take)

Incorrect, again!

Employer is not required to inform about EAD usage. On the contrary, Employer has to inform about discontinuation of H-1B for that employee. That will absolve employer H-1B employer for any condition or payment for wages for conditions such as unproductive time (aka bench).

There is no regulation that requires employer to inform USCIS when employment (and I-9) is filled due to EAD, Green Card, or US citizenship.

_______________________

Not a legal advice.

US citizen of Indian origin

So employer has to inform USCIS about EAD use. But in this case (and termination) the actual H1b cancellation is USCIS decision ?

(The pdf does not state what action USCIS will take)

Incorrect, again!

Employer is not required to inform about EAD usage. On the contrary, Employer has to inform about discontinuation of H-1B for that employee. That will absolve employer H-1B employer for any condition or payment for wages for conditions such as unproductive time (aka bench).

There is no regulation that requires employer to inform USCIS when employment (and I-9) is filled due to EAD, Green Card, or US citizenship.

_______________________

Not a legal advice.

US citizen of Indian origin

hairstyles cool quotes on exams.

dixie

09-25 02:38 PM

I see no harm in contacting him; but your excitement about Chandrasekharan seems curious to me. When people who have themselves immigrated from India (who now have GC/citizenship) are so indifferent about us, how can you expect a second generation indian journalist to "understand" our problems ? He does not seem to have done any articles on immigration; so there is no objective way for us to say whether he is really sympathetic to us or not.

Remember that even anti-immigration organizations like numbersUSA have lots of members who are immigrants themselves or have immigrant parents.

Any comments from Core Team regarding contacting Rajiv ? His parents are immigrants from India,so he will understand the sufferings of legal immigrants !

I think it is better to contact him.

Guys...Any comments ?

Remember that even anti-immigration organizations like numbersUSA have lots of members who are immigrants themselves or have immigrant parents.

Any comments from Core Team regarding contacting Rajiv ? His parents are immigrants from India,so he will understand the sufferings of legal immigrants !

I think it is better to contact him.

Guys...Any comments ?

srini1976

04-15 12:36 PM

Congrats :)

axp817

03-28 01:46 PM

If you worked in CA you need to file the same state. You dont have to file the tax for the state where your employer resides.

Not always true, if the employer withholds tax (OP's case) for a certain state, you HAVE to file returns for that state. Even if the withholding was done in error. The only way around this is to get an amended W-2 from the employer without the withholding. I speak from experience.

An easy way to figure this out is as follows

1. You have to file state tax returns in the state of your residence.

2. You have to file state tax returns in state of employment (where your employer is) IF

the employer withheld taxes (for that state) from your paycheck. Technically, they

shouldn't but if they do, for whatever reason, the only way you wouldn't have to file

returns is if they amend the W-2 and give you a new one without the tax withheld.

3. You have to file state tax returns in the state where you perform work on your

employer's behalf (this applies mostly to consulting scenarios where an employee is

deployed on assignments across the country and the only time you don't have to file

taxes in the third situation is when the work performed was for a short period of time

(less than a certain number of months, I am not sure exactly how many, but I think it is

9 or 10 months).

In many cases the state of residence, employment, etc. are all the same, in some cases they are not.

One of the exceptions is states which don't have state income tax, e.g. Texas.

Of course, having to file returns in so many states doesn't mean you pay tax to each state, usually, the total state tax you end up paying is equal to the state with the highest tax rate.

e.g. if you lived in NJ, employer was in NY, and you drove to a client site in PA for all of 2008, you would file returns in NJ and PA, and if the tax rate in NJ was 6% and PA was 6.1%, you would pay 6.1%, the higher of the two. Of course, if your employer accidentally withheld taxes for NY, then you would have to file for NY, and if NY doesn't agree to give you your withheld money back, then the only way to get it back would be to have your employer give you an amended W-2.

That being said, the OP should be okay since he has now filed CA taxes for 2005 and 2006. There will be a small amount of money owed to CA-Dept. of Revenue as penalty, but that should have been calculated during filing, by whoever did the OP's taxes. If the penalty wasn't paid, the OP can expect a 'bill' from CA-DOR asking for that money.

OP, If I were you, I would look into one more thing. If you were on H-1B when you were in CA, did your employer amend the H-1B LCA to state that CA was the work location? Seeing that taxes were withheld for NJ, they might have not amended the LCA. Speak to your employer and see if that could cause any problems or if there is a way to fix that.

Good luck,

Not always true, if the employer withholds tax (OP's case) for a certain state, you HAVE to file returns for that state. Even if the withholding was done in error. The only way around this is to get an amended W-2 from the employer without the withholding. I speak from experience.

An easy way to figure this out is as follows

1. You have to file state tax returns in the state of your residence.

2. You have to file state tax returns in state of employment (where your employer is) IF

the employer withheld taxes (for that state) from your paycheck. Technically, they

shouldn't but if they do, for whatever reason, the only way you wouldn't have to file

returns is if they amend the W-2 and give you a new one without the tax withheld.

3. You have to file state tax returns in the state where you perform work on your

employer's behalf (this applies mostly to consulting scenarios where an employee is

deployed on assignments across the country and the only time you don't have to file

taxes in the third situation is when the work performed was for a short period of time

(less than a certain number of months, I am not sure exactly how many, but I think it is

9 or 10 months).

In many cases the state of residence, employment, etc. are all the same, in some cases they are not.

One of the exceptions is states which don't have state income tax, e.g. Texas.

Of course, having to file returns in so many states doesn't mean you pay tax to each state, usually, the total state tax you end up paying is equal to the state with the highest tax rate.

e.g. if you lived in NJ, employer was in NY, and you drove to a client site in PA for all of 2008, you would file returns in NJ and PA, and if the tax rate in NJ was 6% and PA was 6.1%, you would pay 6.1%, the higher of the two. Of course, if your employer accidentally withheld taxes for NY, then you would have to file for NY, and if NY doesn't agree to give you your withheld money back, then the only way to get it back would be to have your employer give you an amended W-2.

That being said, the OP should be okay since he has now filed CA taxes for 2005 and 2006. There will be a small amount of money owed to CA-Dept. of Revenue as penalty, but that should have been calculated during filing, by whoever did the OP's taxes. If the penalty wasn't paid, the OP can expect a 'bill' from CA-DOR asking for that money.

OP, If I were you, I would look into one more thing. If you were on H-1B when you were in CA, did your employer amend the H-1B LCA to state that CA was the work location? Seeing that taxes were withheld for NJ, they might have not amended the LCA. Speak to your employer and see if that could cause any problems or if there is a way to fix that.

Good luck,

No comments:

Post a Comment